![[Metroactive News&Issues]](/gifs/news468.gif)

[ San Jose | Metroactive Central | Archives ]

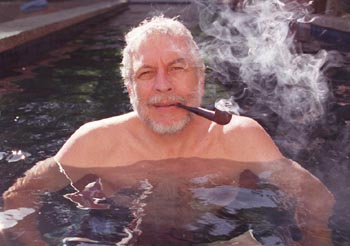

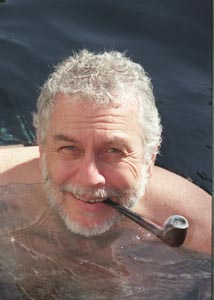

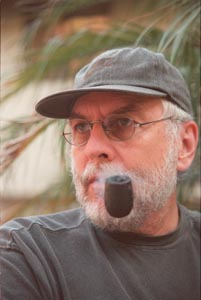

Unshackled: Nolan Bushnell says he can bring ideas to market now that he's no longer being chased by Merrill Lynch.

No Pain, No Game

He loved to gamble and take risks. But when he tried double or nothing, Merrill Lynch changed the rules at the last minute and went for broke.

By Michael Learmonth

NOLAN AND NANCY BUSHNELL sit on small plastic patio chairs alongside a black-bottomed lap pool in the backyard of the rented Los Angeles house they now call home. Their teenage kids, half-dressed in surfwear, saunter in and out while dogs roughhouse in the small courtyard.

He's a fit-looking 56 with short-cropped gray hair, beard and studious oval bifocals. He sets a soda down on the green plastic table, which still has a price tag on it that reads $6.79.

Nancy Bushnell looks fit, too. She has just changed out of workout wear, and at 47 she remains the very portrait of the lithe Californian Bushnell saw tending bar in 1976 at Khartoum, the Campbell fern bar her family owned.

A legal settlement finalized last week marks the end of a crushing 15-year legal battle with the investment house Merrill Lynch that crippled his career for more than a decade. The battle resulted in the loss of the Bushnells' homes, many of their friends and their private assets--and it almost tore their family life apart at the seams.

Today, for the first time since 1968, when he first moved to Silicon Valley as a young man from Salt Lake City, Bushnell does not own a home. They rent a modest Southern California home with out-of-date decor and not enough room to squeeze a guest's car in the driveway. "We're homeless," he says, only half-jokingly.

The Bushnells refuse to discuss the settlement or any aspect of the Merrill Lynch litigation. But they share their personal saga, which began with an IPO gone bad in 1983 and ended, finally, with the sale earlier this year of what Bushnell calls the "last asset," their heavily mortgaged Woodside home, for $5 million, 48 hours before foreclosure.

"I think we're going to be here for a while," Bushnell says, puffing on his pipe and surveying the confines that somehow seem cramped with seven family members, a French exchange student and three dogs running around. Inside the sliding glass doors, stacked, framed family pictures vie for limited tabletop space, and unpacked boxes fill the corners. Italian renaissance chairs--what Nancy calls the "Woodside furniture"--and a treadmill stand incongruously in the living room. Nancy apologizes profusely.

"We're really still moving in," she says. "It's been terribly disruptive on the teenagers. To live in the same house their whole lives and then be pulled out of school for five months. We've spent many nights comforting them while crying. It's been emotionally very tough."

"But there have been some really good things that have come out of this," Nolan interjects. "I think our kids are a lot more squared away than they might have been. They've seen life from both sides now."

Photograph by Chris Gardner

THE STORY OF NOLAN BUSHNELL IS deeply enshrined in Silicon Valley lore. It was he who, as an engineering student at the University of Utah, sneaked into the computer labs in the late '60s between 1 and 4 in the morning to play Space War and Fox and Geese on the university's $7 million mainframes. And it was he who saw in those flashing green pixels--before anyone else--the potential for a new industry.

"Remember," Bushnell says, "I didn't invent the video game. They had already been invented on the $7 million computers. I just commercialized them."

But commercialization would have to wait a few more years. After graduation, Bushnell reluctantly turned down a more lucrative job offer as manager of an amusement park he'd been working at in Salt Lake City to take a job as an engineer at Ampex. He picked up his young family in 1968 and moved to an $8,000 house near the intersection of El Camino Real and the Lawrence Expressway. But he couldn't keep the games out of his mind, so he moved his younger daughter, Britta, out of her bedroom and built his first computer game there, a knockoff of Space War called Computer Space.

At age 27 he founded Atari with $250 of his own money and another $250 from business partner Ted Dabney. Bushnell conceived Pong, what would become the world's first commercial video game, and in 1972 Atari's first full-time employee, Al Alcorn, built it.

Atari had revenues of $11 million in 1973. Two years later, that snowballed into $36 million and the company began to write the first quirky chapter in the otherwise strait-laced history of Silicon Valley.

During this time, Atari embraced some of the egalitarian work traditions that later blossomed throughout the valley. There were casual Fridays, jeans at work, beer busts on the loading dock and little tolerance for executive perks like company cars and parking spots. Two Atari employees, Steve Jobs and Steve Wozniak, later installed these traditions at Apple Computer, where they flourished.

But before Apple, Atari was the hot place for engineers to work.

"Everyone and their brother wanted to work for them," says Tim Bajarin, president of Creative Strategies in Campbell. "They all focused on Nolan's view of life, which was it should be fun to come to work. He made it cool to be an engineer."

At the time, the microchip was an exotic type of integrated circuit that resided in scientific devices and air-conditioned rooms. Atari helped seal its destiny as a consumer-electronics workhorse.

"The microprocessor was a technology in search of a marketplace," remembers marketing consultant Regis McKenna. "The thing that came out of [Atari] was low-cost games that were really computers. The stimulus for the personal computer came out of the game concept."

Bushnell sold Atari to Warner Communications in 1976 for $28 million but stayed on as a consultant for another two years. Bushnell's personal net worth grew to between $35 and $50 million--a vast sum at the time--and his celebrity began to spread beyond the valley.

Time called the 34-year-old divorcee a "lapsed Mormon" who admitted to "liking girls" and boasted, "I have a lot of phone numbers in a lot of cities."

Explains Bushnell with a laugh: "I was flamboyant ... young, rich and single. It was the '70s and we just raised a lot of hell."

First Atari took on the coin-operated video-game market and soon dominated it. Then Atari started producing home game systems and Sears promised to buy as many units as they could produce. By the time Bushnell sold the company to Warner, personal computing was the next frontier. Atari introduced the 800 computer, which at the time contained superior technology to the Apple II and the IBM PC, with the exception of the latter's memory management, Bushnell says.

He says that Atari's missteps allowed Apple and Microsoft to emerge as dominant industry players. Chief among these was Warner's sluggishness in accommodating Dan Bricklin's breakthrough spreadsheet program, VisiCalc, on the Atari platform.

Both Bricklin and former VisiCorp CEO Dan Fylstra recall that Atari was quite eager to have VisiCalc run on the 800. "We got an early prototype. It came on a breadboard. We were ready around the time that the 800 came out," Bricklin says.

Nonetheless, "Apple got it first," Fylstra says. "The Atari machine wasn't ready."

"The number-one reason the Apple II made the crossover into business was VisiCalc," Bajarin says.

Fylstra believes Apple's embrace of disk drives over cassettes as a storage device was at least as important. Warner's inept management of its early lead in personal computing, in which it was once a $1 billion player, along with the mid-'80s meltdown of the video game industry, marked the beginning of the long, slow demise of the Atari brand. After a half-billion-dollar operating loss, Atari was fire-sold by Warner in 1984 to the Tramiel family, which downsized it and operated it for 12 years, then reverse-merged it into a disk drive manufacturer, JTS. Early last year, JTS sold rights to the Atari name and products to toymaker Hasbro.

Related Links: Online information about Nolan Bushnell and his past ventures.

BUSHNELL LEFT ATARI BEFORE ITS crash. He was disgusted with Warner's management: its conservatism in rolling out new products, the executive dining room, the four-star chef. And by most accounts, they grew tired of him.

"By the time that my big public 'win,' which was Atari, was in flames under Warner's direction," Bushnell says, "I hadn't called any shots there for five years."

He left the company in 1978 to turn his attention to his next Big Idea.

The first Chuck E. Cheese Pizza Time Theater opened in Town and Country Village in San Jose in 1978. The company went public in 1981 and pushed Bushnell's net worth to $70 million--much of it in Pizza Time stock. The restaurants were a smashing success. While an average Pizza Hut grossed around a quarter million per unit per year, a typical Pizza Time Theater collected $1.3 million by finding ways to suck quarters out of the fingers of parents eager to entertain themselves and their kids with video games. By 1983, 200 Pizza Time Theaters operated in the United States, Canada, Australia and Hong Kong.

In a charmed moment in time, before Atari went into the ICU and while Pizza Time Theaters was riding high, it seemed as though Nolan Bushnell could do no wrong. His modus operandi, as he calls it, was to start a project, get it running like "a Swiss watch, make sure the economics are pristine, and then to move on to something else." It came that time with Pizza Time Theaters, so Bushnell handed the keys to the restaurant side of the business over to a professional management company so he could spend more time on video-game development. He started a business incubator in Sunnyvale called Catalyst Technologies, where he would invest $500,000 a pop in a portfolio of startups.

And some of the ideas did indeed soar. Compower, Axlon, Etak, Androbot and Magna Microwave emerged from the Catalyst cradle. By far the most successful was Etak, which made electronic maps for autos and other navigation uses. It was ultimately purchased by a Rupert Murdoch firm for $50 million.

But while Bushnell focused his efforts on Catalyst and other distractions of the rich and famous, the enterprises that made his name and fortune unraveled.

'THERE WAS NOBODY WHO HAD A better reputation and perception of being a golden boy than I did in 1982," Bushnell says. "Three years later, I was a 'dumbshit.' "

He doesn't really mean that. During the '80s, many of the Catalyst companies returned money to investors--a fact of which Bushnell remains proud. But this time, it was small change.

"After doing Atari and Chuck E. Cheese," he says, "doing a $10 million win here and a $5 million win there--nobody pays attention."

The year 1983 hit with the force of a tsunami, capsizing the good ship Bushnell and triggering a chain of smaller waves that chipped away at Bushnell's personal fortune for the next 15 years.

Though it was no longer his concern, Atari, the brand most closely identified with his name, lost $539 million that year when the video-game industry plunged. Pizza Time, which was gaining a reputation for serving pizza only slightly more tasty than the cardboard disk at the bottom of a delivery box, lost $15 million that year.

In the meantime, Bushnell was traveling the country taking orders for "Bob" and "Topo," personal robots being developed by Bushnell's most promising new startup, Androbot.

To finance the road show and the advance R&D costs, he began taking out personal loans from Merrill Lynch Private Capital Inc., secured by Pizza Time stock. Merrill Lynch had told Bushnell, and announced to the public, that it intended to take Androbot public in the summer of 1983.

"The Androbot offering looked like it was going to be one of the biggest offerings in the history of mankind," Bushnell says with typical understatement. "I mean, people were calling me to get allocations. They said, 'My broker can't get me any stock. I want 1,000 shares.' "

Bushnell provided bridge loans to the company, using his personal credit to draw on the stock-secured line that Merrill offered him. He forwarded the cash to Androbot with the understanding that Androbot would reimburse with capital raised in the offering.

"Then," Bushnell says, "all of a sudden one of [Merrill Lynch's] vice presidents said they were not going to do any more IPOs for companies that weren't profitable yet."

IN TODAY'S HYPERTHYROID ECONOMY, companies need only give a projection of when they might become profitable before they issue stock. Even Merrill Lynch, as traditional as investment banks come, is chucking change at Silicon Valley. "Here at the crossroads of high tech and high finance, investment bankers need to think as boldly as their clients," gushes an advertisement in the tech trade journal Red Herring, in which Merrill Lynch claims to be the "fastest-growing technology investment banking practice in the industry."

But in 1983, the future did not look as limitless as it does today, and the New York financial establishment was behind the curve. Until the mid-'80s, The Wall Street Journal wouldn't run an article about a company that was listed on NASDAQ. And the old-line East Coast investment banks were still skeptical and reluctant to fund high-tech start-ups in Silicon Valley.

"The first time was when Morgan Stanley took Apple public in 1980," Regis McKenna remembers. "And that was a radical event. I remember one investment banker telling me there was only one computer company they were interested in and that was IBM and not to bother them with these little West Coast companies."

When Merrill Lynch reneged on the Androbot IPO, Bushnell had more than $5 million invested. In a financial sense, Merrill Lynch left Bushnell standing there with his trousers around his ankles. But Bushnell wasn't going to let some paper-pushing "vice president somewhere" pronounce his idea DOA. He went on the road again looking for private financing for Androbot, racking up another $10 million in debt along the way. "At that point I was so used to success in businesses I was controlling," he says. "There was a lot of pressure to ramp up production before the product was really finished."

Ever the optimist, he had confidence he could make it work. But as Pizza Time hemorrhaged in 1983, the value of Bushnell's holdings in the company dropped from $23 million to $9 million. Then, in 1984, with Bushnell having racked up $22.8 million in debt financing Androbot and other ventures, Pizza Time filed for bankruptcy under Chapter 11 of the Federal Bankruptcy Code.

"When Chuck E. Cheese went down," Bushnell says, "I was in technical default."

The easy answer, of course, was for Bushnell to declare personal bankruptcy. But that would have led to the dissolution of his assets and might have damaged his name enough to make getting funding for future endeavors impossible. If anything, Bushnell is a gambler and he's always best when the odds are on himself.

He started paying Merrill Lynch back. And this meant chasing cash flow. In 1986 he sold the Paris house for $8 million and he started turning over profits on other Catalyst enterprises to Merrill Lynch. It was a slow and arduous process, but by 1990, Bushnell had paid $27.5 million on the original $22.8 million debt plus interest.

"There were a lot of personal assets, real estate and stuff, that we put in," Bushnell says. "It wasn't like I was a deadbeat."

In 1990, Bushnell commenced discussions with Merrill Lynch on how to satisfy his remaining indebtedness. In 1992, they agreed verbally that one final payment of $500,000 plus interest, payable on or before June 21, 1995, would satisfy the balance of the debt. If Bushnell paid after that date, the balance would escalate seven times to $3.5 million. Bushnell thought he saw the light at the end of the tunnel.

IN 1995, NOLAN BUSHNELL WAS rewriting his own history, or else having it rewritten for him in the press. "King Pong" was on a comeback, the stories said. This time his new enterprise, E2000, was to revolutionize family entertainment as much as Atari or Chuck E. Cheese did. "This was essentially to be the rebirth," Bushnell says. E2000 was to be on the scale of Sony's new Metreon in San Francisco, except, he says, "with a lot more innovation, a lot more group play."

But in February that year, five months before his $500,000 note plus interest came due for Merrill Lynch, the investment house filed suit against him in Santa Clara County Superior Court for seven times the original sum: $3.5 million.

Merrill Lynch admitted a mistake in the timing of the suit--five months before the note was due--and they dismissed it. But it was a critical moment for E2000, and the damage was done.

"All of a sudden it looked like I had a $6 million judgment against me," Bushnell says. "[E2000] was stillborn at that point."

Because of the suit, most of the E2000 investors backed out and took their $2.5 million with them, crippling Bushnell's ability to pay an amount that seemed meager compared to the tens of millions he'd already paid back.

In the press, E2000 faded without much notice. The last thing most people read about it was that the first location was to be in Silicon Valley. The impression left fit snugly into Bushnell's public persona: "creative guy, but too scattered to follow through."

"No one could ever fault me for not having ideas," he says. "The people who don't understand risk say, Gee, Nolan's all over the place. Well, horseshit! I was the one who sweated the payroll at Atari, implemented just-in-time inventory and structured the thing so it operated with positive cash flow. That is the part that is barely understood."

Now, as the Internet took off and Silicon Valley flooded with money and entrepreneurs, Bushnell was in a fight for his home and, in a larger sense, his family.

When the note came due five months later, Bushnell was unable to pay and Merrill Lynch sued again, this time winning a $6.1 million judgment, including interest and attorney's fees.

"We entered into various agreements to loan Mr. Bushnell money and on more than one occasion restructured loan agreements," says Merrill Lynch spokesman Bill Halldin. "Finally, when he did not repay his obligations, we took appropriate legal steps to protect the rights of our company and our shareholders."

Bushnell appealed the judgment to the 6th District Court of Appeals, claiming it had been the wrongful acts of Merrill Lynch that made him unable to pay. But the judgment was affirmed and Merrill Lynch commenced a blitzkrieg on any asset it could even loosely affiliate with Nolan Bushnell. This included items listed as Nancy's in a Merrill Lynch-approved prenuptial agreement, including her half of the Woodside mansion and her personal possessions. It obtained permission from a judge to enter the mansion with San Mateo County Sheriff's deputies to recover property listed as Nancy's: an antique china cabinet, two other cabinets and four Middle Eastern rugs valued at $249,016.

Then Merrill Lynch went after the Lion & Compass Restaurant, founded with Bushnell's help in 1982 and run by a corporation controlled by Nancy Bushnell's family, the Ninos. They even tried to attach the Bushnells' eldest son's savings account. It contained $348.

"This is where Nancy became so emotional," says family friend and real estate broker Georgie Huff. "They had a judgment against Nolan, but they used the court system to say they were entitled to other things."

Bushnell realized then that he would have to sell the asset nearest and dearest to his heart. "To me, personally, I had a lot of my ego and psyche wrapped up in my home," Bushnell says. "It symbolized the last asset. It was an island in some ways, the kind of place I thought in my heart of hearts I would always be able to hang on to. That I could make enough money to keep the family going."

THE WOODSIDE MANSION WENT ON the market in 1997, but Merrill Lynch encumbered the sale by filing a lien against Nancy Nino Bushnell's share in the property. The lien that Merrill Lynch had against the residence allowed them to stop any sale unless the proceeds--even Nancy's--were used to pay off the judgment.

Nancy Bushnell countersued. It was her husband--not her, after all--who had a judgment against him. Her attorney, Joseph Carcione Jr. of Redwood City, laid out an impassioned defense.

"Stop hammering this woman into the ground," he wrote. "Stop making her consider everything from divorce to jumping off of a bridge. I'll say it again. You have no damn right to be trying to compel Nancy Bushnell to do anything with her money that she has coming out of any sale."

The Bushnells' broker received three qualified offers for the house, but the first two buyers backed out, doubting that the title would ever be clear.

Merrill Lynch kept the heat on the Lion & Compass as well. Bushnell owned the land beneath, leased it to the restaurant and then paid the mortgage with the proceeds. But the rent money never passed through Bushnell's hands; it went straight to the bank. So in an attempt to attach the rent, Merrill Lynch approached the bank, which started putting the rent proceeds into a receiver account. Since the mortgage wasn't getting paid, the bank foreclosed on the property in December 1997.

Merrill Lynch also claimed the restaurant owed Bushnell $300,000, which it sued the restaurant to recover.

"It's shocking to me the degree of vengeance. They flew out these obnoxious New York lawyers on the redeye for a 10-minute appearance in court. I'll never know what motivated them. I don't think it was really about money," brother Dennis Nino says.

"The most outrageous thing is Bushnell had overpaid them on the note, yet they were pursuing him for a few hundred thousand dollars and destroying a family restaurant in the process."

To stop the court action, the Nino family decided the Lion & Compass should declare bankruptcy. They managed to keep it in the family by having another brother of Nancy's, Robert Nino, buy it, as they say, "on the courthouse steps."

AS DISTASTEFUL AS IT SEEMED, THE prospect of personal bankruptcy became more real to Bushnell as the foreclosure date for the mansion approached.

"Nolan is an old-fashioned man," Huff says. "Sometimes bankruptcy can be a good business decision, but he would never have accepted it."

Finally, at 5pm on Friday, 48 hours before a scheduled foreclosure, Merrill Lynch called Bushnell attorney Carcione and told him they would allow the sale to proceed.

The house sold for $5.5 million. Merrill Lynch received a quarter million from the sale and the Bushnells and Merrill Lynch reached a settlement in August for an undisclosed sum.

On the day they lost the property, Nancy Bushnell tried to distract her children by playing a game of "sardines" in the massive, empty house.

"It was like a wake," says Huff, who had spent the night helping the Bushnells pack.

They turned over the keys to the place in the afternoon and then moved into Nancy's parents' living room for a week. Then the family flew straight to London and stayed for five months, partly to get away, partly to ease the family's transition into a whole different environment and lifestyle.

"It was sort of a way for our family to get reacquainted again," Bushnell says, "because we had been under a severe amount of stress--the whole family--for a long time."

The experience, Bushnell says, taught him a lot about the people who once surrounded him in Silicon Valley.

"Some of the normal business courtesies that used to happen in a femtosecond didn't happen at all," he says.

At one point, to keep their house out of foreclosure, the Bushnells took out a $3 million mortgage that cost $35,000 a month to service. When Bushnell was short, he turned to friends.

"It was very interesting to see who sticks by you," Nancy Bushnell says. "These were emotionally devastating times. Some friends were just there for us. There were occasions when we were borrowing money."

"They always paid it back," says Huff, who loaned Bushnell money. "I was happy to help. No one ever believed it would go as far as it did."

"The last thing I want to do is elicit pity," says Bushnell. "Because in a lot of ways, all the important things are really great. I have a beautiful wife, wonderful kids, and we've had a great year's experience."

Now that the shackles of debt, legal briefs and most of his possessions are gone, it's easier for Bushnell to look on the bright side of things. "You can be anything you want in L.A.," Bushnell says, hinting that it's his plan to stay put for a while.

It should be no surprise to anyone that Bushnell is planning to unleash his greatest asset--his mind--on yet another venture. This one will be a different take on a company called PlayNet. Though that company went bankrupt last year, Bushnell still believes the market niche is there. Under the name Uwink.com, Bushnell plans to start developing coin-operated game machines, networked over the Internet and placed in public places like bars and restaurants. He's got two other business plans lined up, mind you, but he's promised not to utter a peep about them until Uwink.com becomes an entertainment juggernaut.

The idea of Nolan Bushnell coming out to play again makes even the whippersnapper Internet VCs giddy. Many of them grew up playing Asteroids and Space Invaders.

"It would be an absolute honor to work with someone like him," gushes venture capitalist Warren Packard, 31, of Draper Fisher Jurvetson. "His creativity knows no bounds. It doesn't matter about your age, but your energy, enthusiasm and intellect."

With the Internet and the amount of venture capital circulating, the barriers to starting such an enterprise are far lower now than when Bushnell bootstrapped Atari.

"It really doesn't require the kind of huge capital investment to get your ideas in the marketplace today," McKenna says. "He may be even more relevant today because he is an out-of-the-box thinker."

Bushnell is getting ahead of himself. If Uwink.com is successful, he says, he's taking another run at the video-game industry. Atari version 2.0.

"It's a constant source of frustration to me that the video-game industry is dominated by Japan," he says. "It started here; the U.S. should dominate. ... Nintendo and Sony can be dethroned, and they should be."

Bushnell disappears into his garage. A true Silicon Valley man, he has no cars in there, just computer monitors, soldering irons, walls of books, software and little drawers full of screws, switches and metal fasteners.

He emerges with a box full of old magazines from the late '70s and early '80s. Most of the stories dwell on his myriad "falls" and "comebacks." Since you're only written up in Fortune if you're winning big or getting screwed, Bushnell says his goal is to make the magazine "an odd number of times."

As Bushnell wistfully flips through the pages, his second-youngest son, Dylan, who is 7, looks over his shoulder.

"Dad," he asks, "are you famous?"

"Not anymore," Bushnell says.

"C'mon, Dad, get famous again," he implores.

Without looking up, Bushnell replies, "I'm working on it."

[ San Jose | Metroactive Central | Archives ]

![]()

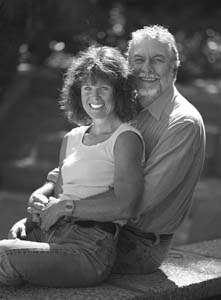

Photograph by Chris Gardner

To Have and To Hold Accountable: Nancy Bushnell, as Nolan's wife, came under fire during his legal struggles. At one point, Merrill Lynch went after her family's restaurant and her son's bank account, inspiring her attorney to write: 'Stop hammering this woman into the ground.'

To Have and To Hold Accountable: Nancy Bushnell, as Nolan's wife, came under fire during his legal struggles. At one point, Merrill Lynch went after her family's restaurant and her son's bank account, inspiring her attorney to write: 'Stop hammering this woman into the ground.'

![[line]](/gifs/line.gif)

![[line]](/gifs/line.gif)

Photograph by Chris Gardner

Photograph by Dan Pulcrano

From the September 16-22, 1999 issue of Metro, Silicon Valley's Weekly Newspaper.