Identity Crisis

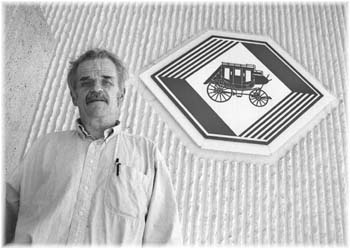

Name Recognition: Credit fraud victim Jon Stanton says he had no idea his identity had been stolen until Wells Fargo called, asking him to settle his past-due credit card account. He then learned that a woman, posing as his spouse, had gotten cards in his name and run up bills in the thousands.

After carelessly issuing a phony card and wrecking a Saratoga man's credit, Wells Fargo takes its time about straightening out a local fraud case

By J. Douglas Allen-Taylor

IT IS THE MIDDLE OF A BLISTERING summer day, the first of August, and Jon Stanton is in his office at H&R Block on Bascom Avenue, returning a phone call to Wells Fargo Bank. He figures it's probably a question about a tax return he's worked on. For a tax preparer and accountant, it's just one more small item to be taken care of in a busy day, and the Saratoga resident doesn't think much of it. He soon will.

The bank representative has bad news. She tells Stanton that his Wells Fargo credit card has run up $8,500 in charges, the payments are well overdue, and Stanton needs to put a check in the mail immediately.

Stanton is puzzled. "That can't be," he says. "I don't have a Wells Fargo credit card. I don't even bank with Wells Fargo."

The representative takes a second to check her computer screen. The problem is with Stanton's wife, Lorie. She's the one who opened up the credit card account, though she used Jon's name and Social Security number and his job at H&R Block as references.

Stanton is patient. He's dealt with financial institutions for a long time. He's accustomed to mistakes showing up in computer files. He tells the Wells Fargo representative that he doesn't have a wife named Lorie. He doesn't have a wife at all. He's been divorced since 1979, he says.

As he's explaining all of this, Jon Stanton's face bears the quizzical, slightly befuddled expression of a man who cannot quite believe his sudden run of bad fortune. With tousled gray hair and a comfortably rumpled demeanor, his is a look Peter Falk might have copied for his Columbo television character. Soon, the 48-year-old Stanton will have need of the disheveled detective's considerable deductive skills.

Stanton has become a victim of a classic '90s crime--identity theft. And after two months and many hours of investigating, phone-calling and letter-writing, his credit is still shot, and he still is not sure when his ordeal will end.

On the phone with Wells Fargo, Stanton continues to insist that the whole thing is a mistake, and the credit charges are not his. The Wells Fargo representative tells him that he will not be responsible for the charges, but he must sign an affidavit. She promises to send it in the mail.

Before the affidavit arrives, Stanton gets another jolt of bad news: a notice that he has been denied credit from an application he made a few weeks before. Apparently, Wells Fargo has had a bad notice put on his credit card report. Stanton immediately sends for copies of his files from the three big credit card reporting agencies: Equifax (formerly TRW), Experian and Trans Union.

Stanton gets a terrible sinking feeling when the reports come back. "Lorie Stanton" has been having a ball as Stanton's "wife." She has run up charges at Nordstrom and the Outback and several local establishments. She's flown to Reno on the Wells Fargo card, tapping the cash-advance ATM a couple of times for good measure.

She has opened up a charge account at Sears as Stanton's wife, running up a $5,000 bill on that card. She has also gotten a Macy's account, though she never gets around to charging anything. She's applied for six other credit accounts, all of which have turned her down for one reason or another. Straightening all this up is clearly going to be a huge mess.

Stanton seeks religious guidance. His church pastor suggests that he might get assistance from the police department in Campbell, where Stanton lived at the time. Stanton eventually talks to Detective Gary Marshall, who promises to look into the situation. But there the matter stalls.

Marshall contacts Wells Fargo in early September. He is told that the bank has no knowledge of the matter and will get back to him. It never happens.

Marshall cannot talk about the matter to the press, but his supervisor confirms that under the rules of credit card fraud, Jon Stanton is not considered the victim--Wells Fargo is. Until Wells Fargo decides to act, the Campbell Police Department will not even investigate the case.

How theives get your identity and what you can do about it.

Credit Raiding

SEVERAL WEEKS PASS and Jon Stanton has not received his promised affidavit in the mail from the bank. He calls back, and a Wells Fargo representative insists that it has been sent and should already have been received. "I asked them what address they sent it to," Stanton says. "It turns out they sent it to Lorie Stanton's post office box. Can you imagine that?"

When Stanton finally gets the affidavit from Wells Fargo, he discovers that the bank is busily locking the barn door while the stagecoach and four horses careen away down the road.

"In order to effectively research your claim, your cooperation is required," the Wells Fargo Fraud Representative writes. "Please complete and sign the attached statement in the presence of a Notary Public. We require the Notary's signature and stamp as well as copies of your driver's license and Social Security card prior to researching your dispute."

Stanton provides all the information "Lorie Stanton" was not required to provide in opening up the account, signs the affidavit and sends it in on Sept. 3.

Meanwhile, Stanton thinks he has figured out how "Lorie Stanton" got his information.

During a trip to the Willow Glen post office on Meridian Avenue--where "Lorie Stanton" has listed her post office box--Stanton discovers that the box is actually in the name of Lorie Hill, a.k.a. Lorie Galvin. On a hunch as to where she might have discovered his work number, Stanton then checks his back files at H&R Block. He learns that, yes, indeed, he did the tax returns for a Lorie Galvin in 1995. And by law, as a paid tax preparer he was required to put his Social Security number at the bottom of the form.

If, indeed, Lorie Galvin has lifted Stanton's identity and run up his credit card bills, she's had practice. The San Jose resident pleaded nolo contendere in San Jose Municipal Court earlier this year to the same charges, admitting to bilking someone out of more than $9,000 in credit charges. She is currently on probation from her conviction on those charges.

But with the Campbell Police Department investigation stalled while waiting for Wells Fargo's go-ahead, Galvin is not presently under investigation on the Stanton charges.

In the meantime, Sears has received Stanton's affidavit and has taken the charges off of his credit report. But two months after Stanton was first contacted by the bank, the bad credit listings from Wells Fargo remain.

A spokesperson for Wells Fargo confirmed that Stanton was not responsible for the charges, saying that he was informed of that by a bank supervisor on Aug. 20. She said that following press inquiries, Wells Fargo is "trying to expedite clearing up Mr. Stanton's credit report--we've already sent them the information, and we've taken the extra step of talking to the credit bureaus on the phone."

When asked why it has taken so long to clear up the matter, the spokesperson said that while Stanton sent his affidavit to the bank in early September, it was not received "in the appropriate department until Sept. 22."

Meanwhile, Jon Stanton still waits for good credit again.

Santa Clara County Deputy District Attorney Al Weiger doesn't think Wells Fargo's actions are unusual.

"I assume a lot of these big companies think this is the cost of doing business," he said. "It's just too much trouble going to court after people who are defrauding them on one card. The banks just write it off."

[ Metro | Metroactive Central | Archives ]

Christopher Gardner![[line]](/gifs/line.gif)

![[line]](/gifs/line.gif)

From the Oct. 16-22, 1997 issue of Metro.

![[Metroactive News&Issues]](/gifs/news468.gif)